Highlight

Our Department is now recruiting:

– Associate Professor

Our computer laboratory (LSB G25) will be reserved for special activities in the dates below. Hence, it will not be opened for students’ access.

– 25 Apr: 16:00-22:00 (RMSC5102)

– 27 Apr: Full Day (STAT5103)

– 29 Apr: Full Day (RMSC4001)

– 07 May: 12:00-16:00 (STAT4008)

Students Related Affairs

24 April 2024

Student Issues

Exchange Trip to The Southern University of Science and Technology, Shenzhen

View here (pdf) for detailed information.

Download Application Form (pdf).

(Application Deadline: 12:00pm, 7 May 2024)

18 March 2024

Student Issues

Department Summer Internship 2024

22 February 2024

Student Issues

Resources for Major Students

- Video Introduction to Resources of Statistics Department (MP4/384MB)

- Renovated computer labs;

- Bloomberg terminals;

- Data resources and

- High performance computing clusters.

Social Gatherings The Community

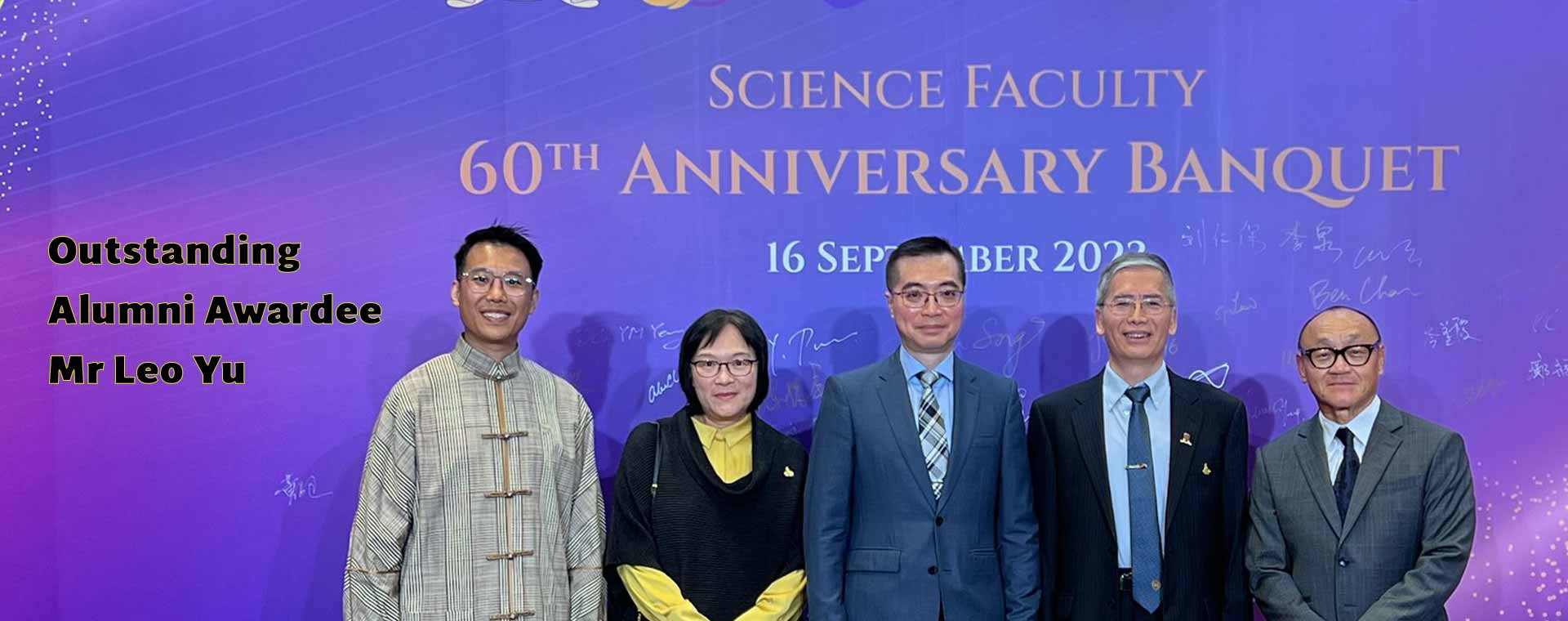

Science Faculty Distinguished Alumni- Engagement Session with Staff and Students

20 April 2024

More Information > LATEST SEMINARS & EVENTS

The Latest News of the Department

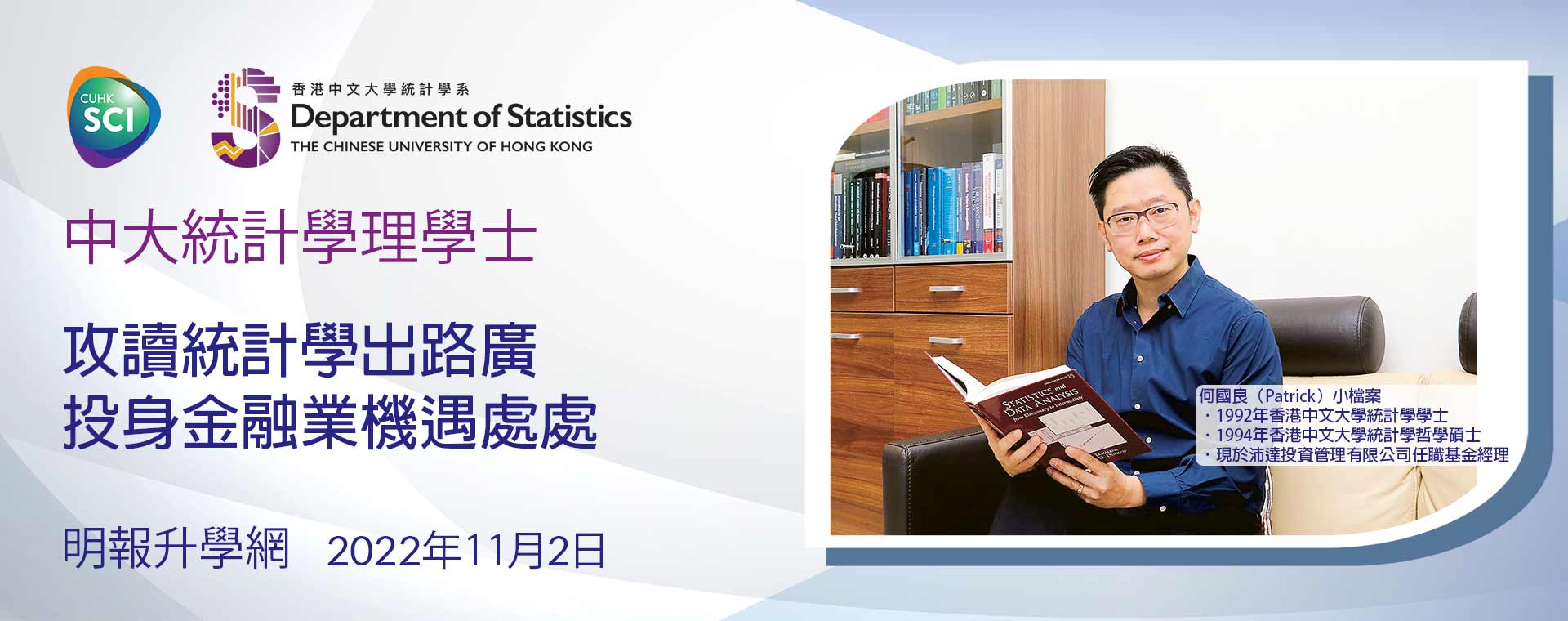

Undergraduate Studies

Postgraduate Studies

Teacher Quote

Explore More >Alumni Quote

Explore More >Contact Us

Department of Statistics

Room 119, Lady Shaw Building

The Chinese University of Hong Kong

Shatin, N.T.

Hong Kong SAR, China

Get Direction >

Contact Us

Department of Statistics

Room 119, Lady Shaw Building

The Chinese University of Hong Kong

Shatin, N.T.

Hong Kong SAR, China

Get Direction >