Highlight

Our Department is now recruiting:

– Associate Professor

Our computer laboratory (LSB G25) will be reserved for special activities in the dates below. Hence, it will not be opened for students’ access.

– 23 Apr: 16:00-22:00 (STAT5102)

– 25 Apr: 16:00-22:00 (RMSC5102)

– 27 Apr: Full Day (STAT5103)

– 29 Apr: 16:00-22:00 (RMSC4001)

– 07 May: 12:00-16:00 (STAT4008)

Students Related Affairs

18 March 2024

Student Issues

Department Summer Internship 2024

22 February 2024

Student Issues

Resources for Major Students

- Video Introduction to Resources of Statistics Department (MP4/384MB)

- Renovated computer labs;

- Bloomberg terminals;

- Data resources and

- High performance computing clusters.

06 February 2024

Student Issues

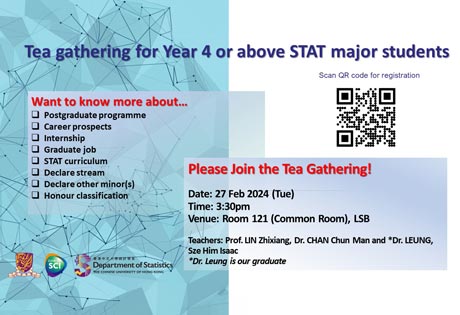

Tea gathering for Year 4 or above STAT major students

Date: 27 Feb 2024 (Tue)

Time: 3:30pm

Venue: Room 121 (Common Room), Lady Shaw Building

Registration: CU WebForm

(please register by 25 Feb 2024)

Social Gatherings The Community

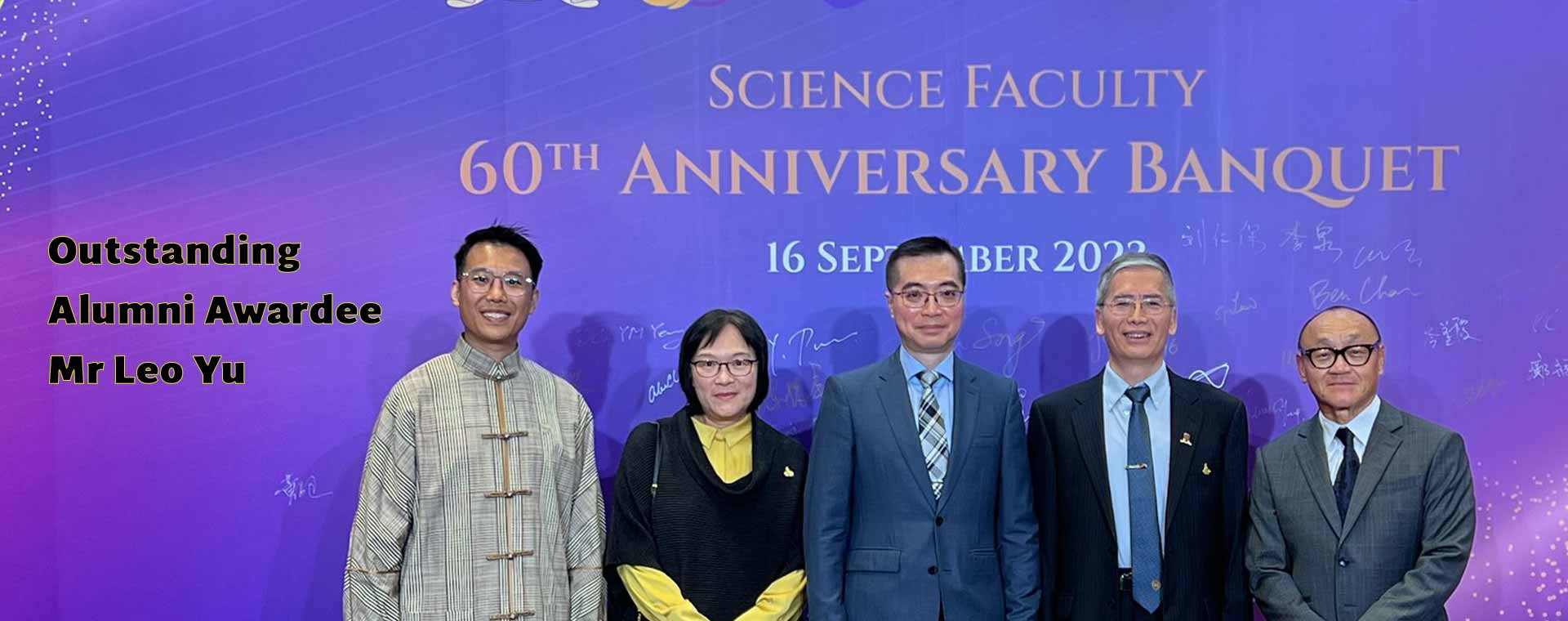

Science Faculty Distinguished Alumni- Engagement Session with Staff and Students

20 April 2024

More Information >

LATEST SEMINARS & EVENTS

The Latest News of the Department

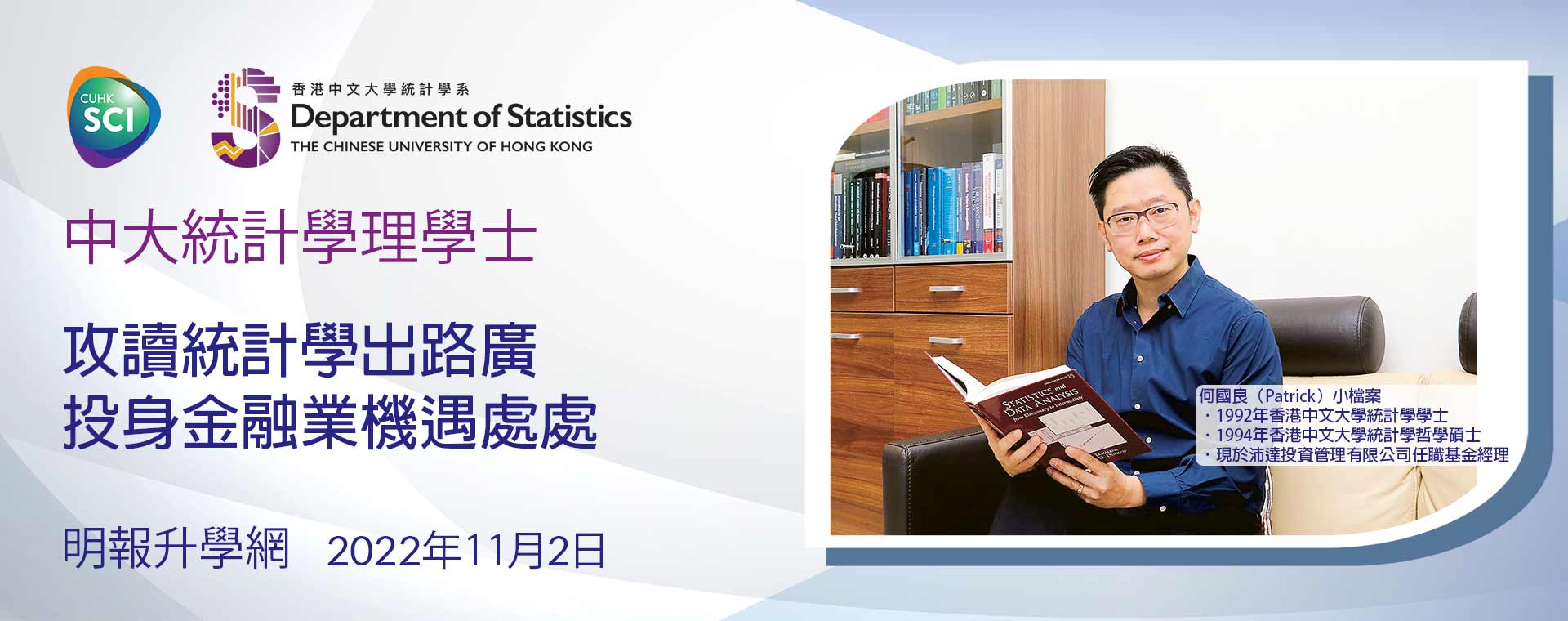

Undergraduate Studies

Postgraduate Studies

Teacher Quote

Explore More >Alumni Quote

Explore More >Contact Us

Department of Statistics

Room 119, Lady Shaw Building

The Chinese University of Hong Kong

Shatin, N.T.

Hong Kong SAR, China

Get Direction >

Contact Us

Department of Statistics

Room 119, Lady Shaw Building

The Chinese University of Hong Kong

Shatin, N.T.

Hong Kong SAR, China

Get Direction >